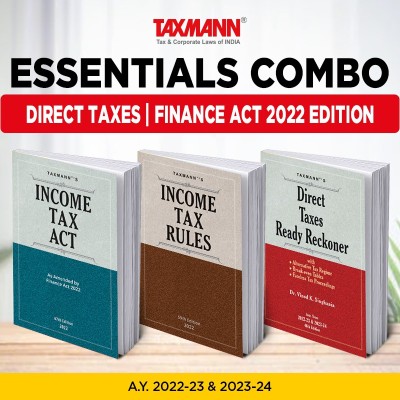

TaxmannŌĆÖs Essentials Combo For Direct Tax Laws | Income Tax Act, Income Tax Rules & Direct Taxes Ready Reckoner | Set Of 3 Books | A.Y. 2022-23 & 2023-24 | 2022 Edition(Paperback, Dr. Vinod K. Singhania, Taxmann)

Quick Overview

Product Price Comparison

These books, authored by Taxmann's Editorial Board & Dr Vinod K. Singhania, are a COMBO for the following books on Direct Tax Laws: (1) Taxmann's Income Tax Act | 67th Edition | 2022 (2) Taxmann's Income Tax Rules (Set of 2 Vols.) | 59th Edition | 2022 (3) Taxmann's Direct Taxes Ready Reckoner | 46th Edition | A.Y. 2022-23 & 2023-24 The key features of these books are as follows: Taxmann's Income Tax Act This book covers the Amended, Updated & Annotated text of the Income-tax Act, Finance Act 2022 & Taxation Laws (Amendment) Act, 2021. The Present Publication is the 67th Edition and amended by the Finance Act 2022 & the Taxation Laws (Amendment) Act, 2021. This book is authored by Taxmann's Editorial Board, with the following noteworthy features: (1) [Coverage] of this book includes: (i) Division One ŌĆō Income-tax Act, 1961 (┬¦) Arrangement of Sections (┬¦) Text of the Income-tax Act, 1961 as amended by the Finance Act, 2022 and Taxation Laws (Amendment) Act, 2021 (┬¦) Appendix: Text of provisions of Allied Acts/Circulars/Regulations referred to in Income-tax Act (┬¦) Validation Provisions (┬¦) Subject Index (ii) Division Two ŌĆō Finance Act, 2022 and Taxation Laws (Amendment) Act, 2021 (2) [Annotations] under each section shows: (i) Relevant Rules & Forms (ii) Relevant Circulars & Notifications (iii) Date of enforcement of provisions (iv) Allied Laws referred to in the section (3) [Legislative History of Amendments] since 1961 (4) Comprehensive Table of Contents (5) [Quick Navigation] Relevant section numbers are printed in folios for quick navigation (6) [Bestseller Series] Taxmann's series of bestseller books for more than five decades (7) [Zero Error] Follows the six-sigma approach to achieve the benchmark of 'Zero Error' Taxmann's Income Tax Rules This book covers the Amended, Updated & Annotated text of the Income-tax Rules and 20+ Allied Rules. The Present Publication is the 59th Edition & updated till the Income Tax (Fifth Amendment) Rules 2022, authored by Taxmann's Editorial Board, with the following noteworthy features: (1) [Coverage] of this book includes: (i) All Rules and Schemes, which are either notified under the Income-tax Act or referred to in different provisions of the Income-tax Act, are covered o Return Forms for A.Y. 2022-23 (i) Contains 23 divisions covering all Rules relevant under the Income-tax Act, i.e., (┬¦) Income-tax Rules (┬¦) ICDS (┬¦) Faceless Assessment, Appeal & Penalty Scheme with Directions (┬¦) STT, CTT & EL, etc. (2) [Action Points for Forms] All Forms carry Action Points that explain the Relevant Provisions and Process of Filing (3) [Quick Identification for Redundant & e-Forms] (4) [Bestseller Series] Taxmann's series of Bestseller Books for more than Five Decades (5) [Zero Error] Follows the Six Sigma Approach to achieve the benchmark of 'Zero Error' Taxmann's Direct Taxes Ready Reckoner Taxmann's bestseller for 40+ years is a ready-referencer for all provisions of the Income-tax Act, covering illustrative commentary on the Finance Act 2022. The Present Publication is the 46th Edition & amended by the Finance Act 2022 for A.Y. 2022-23 & 2023-24. Dr Vinod K. Singhania authors it with the following noteworthy features: (1) [Focused Analysis] without resorting to paraphrasing of sections and legal jargons, on the following: (i) [Amendments made by the Finance Act, 2022] are duly incorporated in respective Chapters of the Reckoner and are appropriately highlighted (ii) [Comprehensive Analysis of Amendments with Illustration] are given separately in Referencer 2: Amendments at a glance (┬¦) Complex provisions (such as taxation of Virtual Digital Assets, Updated Return, etc.) have been explained by way of case studies (iii) [Analysis of all provisions of the Income-tax Act] along with relevant Rules, Judicial Pronouncements, Circulars and Notifications (2) [Faceless Tax Proceedings] provides the summary of all the legal provisions (3) [Analysis on Alternative Tax Regime] along with Break-even Tables (4) [Tabular Presentation] of all key provisions of the Income-tax Act (5) [Computation of Taxes] on various slabs of income (6) [Ready Referencer] for tax rates, TDS rates, TCS rates, due dates, etc. (7) [Zero Error] Follows the six-sigma approach to achieve the benchmark of 'zero error'